In a bold move that underscores the growing demand for artificial intelligence (AI) infrastructure, Apollo Global Management has announced plans to acquire a leading builder of large-scale US data centers. The private equity giant aims to capitalize on the surge in AI-driven computing needs by investing heavily in facilities that power next-generation cloud and AI workloads.

The deal, estimated to be worth several billion dollars, reflects a broader trend of institutional investors betting on the exponential growth of data infrastructure as tech giants and enterprises race to deploy advanced AI systems.

AI Boom Fuels Data Center Gold Rush

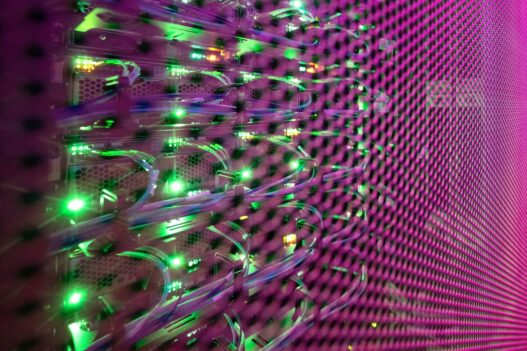

Data centers have become the backbone of the AI revolution, housing the powerful servers and GPUs required to train and operate AI models from companies like OpenAI, Nvidia, and Google DeepMind. As AI adoption accelerates across industries, the demand for ultra-secure, high-capacity, and energy-efficient facilities has skyrocketed.

Apollo Global’s acquisition aligns with its long-term strategy of investing in mission-critical infrastructure. By targeting a specialized builder of hyperscale data centers, Apollo seeks to cement its role as a key player in the digital economy’s backbone.

“AI-driven computing is transforming the world at an unprecedented pace,” said an Apollo spokesperson. “This acquisition positions us at the center of that transformation, enabling us to deliver the infrastructure necessary to support massive computational workloads.”

The Strategic Significance of the Deal

The acquisition is expected to:

- Accelerate the development of hyperscale AI-ready data centers in the US.

- Strengthen Apollo’s portfolio in high-growth digital infrastructure.

- Support partnerships with major AI developers and cloud providers.

- Address growing national interest in securing domestic AI computing capacity.

As US companies push for onshore AI data facilities to reduce reliance on overseas infrastructure, Apollo’s move also taps into regulatory and policy priorities emphasizing data sovereignty and security.

A $1 Trillion Market Opportunity

Industry analysts project that the global data center market could surpass $1 trillion by 2030, driven largely by AI-related workloads, cloud expansion, and edge computing. With generative AI models requiring exponentially more computing power, infrastructure investors like Apollo are positioning themselves for explosive returns.

Apollo’s acquisition also mirrors similar plays by infrastructure funds, sovereign wealth entities, and even tech titans like Microsoft and Amazon, which are pouring billions into expanding their data center footprints.

Next Steps

Following regulatory approval, Apollo plans to integrate the acquired builder into its infrastructure portfolio, accelerating projects in key US tech hubs such as Northern Virginia, Texas, and Arizona. Insiders suggest that Apollo may also pursue international expansion, targeting markets in Europe and Asia where AI adoption is rising sharply.

With this acquisition, Apollo Global not only strengthens its role in digital infrastructure but also becomes a critical enabler of the AI revolution, ensuring that the computational power fueling tomorrow’s breakthroughs is firmly grounded in facilities it owns and operates.