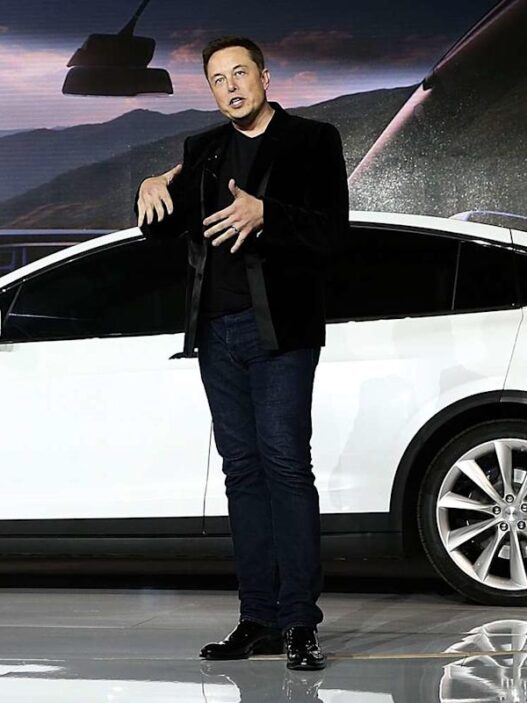

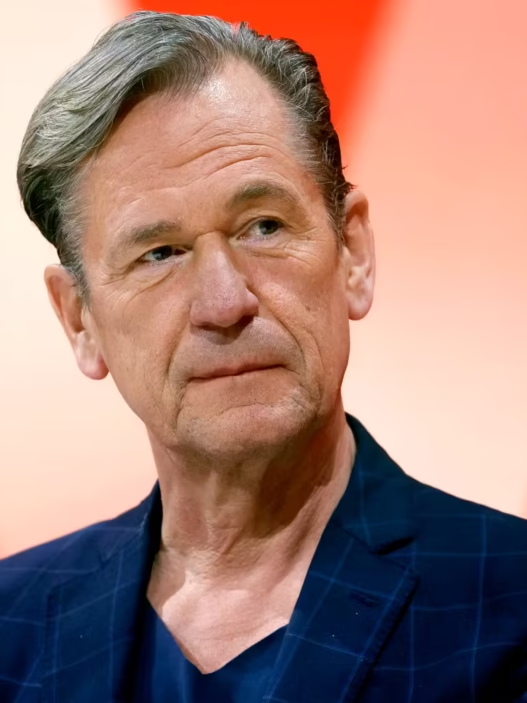

As the artificial intelligence boom continues to captivate investors and reshape industries, billionaire investor Jim Chanos, famously known for shorting Enron before its 2001 collapse, is issuing a stark warning. Far from the “golden age of fraud” that marked the early 2000s, Chanos suggests the current AI-driven market frenzy could be entering an even higher-risk phase, one he calls the “diamond or platinum level” of potential corporate misrepresentation.

Lessons From Enron

Chanos built his reputation exposing corporate malfeasance. His short of Enron, which at the time was one of the largest energy companies in the U.S., earned him widespread recognition. Enron’s complex accounting practices and opaque financial statements masked billions in losses, ultimately leading to one of the most infamous corporate collapses in history.

Reflecting on that era, Chanos notes that while investors and regulators learned some lessons, the scale and sophistication of today’s AI economy may pose even greater challenges.

- “Enron was a warning,” Chanos said in a recent interview. “But now, with AI, we’re not just talking about accounting tricks. The hype is so pervasive that even credible companies are at risk of being overvalued based on projections that may never materialize.”

AI’s Exponential Hype

Artificial intelligence has become the centerpiece of investment portfolios, with companies touting AI capabilities to justify skyrocketing valuations. Chanos warns that the combination of:

- Rapid technological adoption – Businesses racing to integrate AI into products and services.

- Aggressive investor expectations – Stock prices inflated on future potential rather than current revenue.

- Complex corporate disclosures – Financial statements that may not fully capture AI-related risks.

…creates a climate where even well-intentioned companies could inadvertently mislead investors.

“Investors must differentiate between genuine innovation and inflated promises,” Chanos said. “In the AI boom, the stakes are higher. That’s why I call it diamond or platinum level—it’s beyond what we saw in the early 2000s.”

Red Flags for Investors

Chanos advises investors to remain vigilant and skeptical, highlighting several warning signs in the AI sector:

- Unrealistic growth projections – Startups or public companies projecting outsized revenue with minimal traction.

- Opaque business models – AI claims that are difficult to independently verify.

- Aggressive fundraising narratives – Pressure on investors to participate in private rounds at elevated valuations.

- High dependence on key personnel – Success hinging entirely on a few executives or founders.

While the AI market offers transformative potential, Chanos emphasizes that “unquestioning enthusiasm can be dangerous” and could create opportunities for fraud or gross misrepresentation.

Balancing Optimism With Caution

Despite his warnings, Chanos is not dismissing AI entirely. He acknowledges the technology’s legitimate capabilities in automating tasks, optimizing operations, and generating insights across industries.

The key, he argues, is disciplined scrutiny:

- Analyze AI companies’ actual revenue and profitability rather than speculative models.

- Examine how AI is integrated into products and whether results are verifiable.

- Consider regulatory and ethical risks, which may expose companies to fines or operational setbacks.

Historical Perspective

Chanos’ insights come at a time when Wall Street and global markets are abuzz with AI enthusiasm. Analysts have compared the current investment fervor to past bubbles, including the dot-com boom of the late 1990s. But Chanos suggests that today’s risks are more sophisticated and embedded: AI is not just a sector—it is a paradigm shift across multiple industries, making overvaluation and potential misrepresentation harder to detect until it’s too late.

Conclusion

From exposing one of the largest corporate frauds in history to assessing today’s AI boom, Jim Chanos warns that investors must remain vigilant. While the promise of AI is immense, the risks—both of overvaluation and potential corporate misrepresentation—are at an unprecedented level.

For those investing in the AI revolution, the lesson is clear: enthusiasm must be tempered with skepticism, due diligence, and a focus on real, verifiable outcomes.