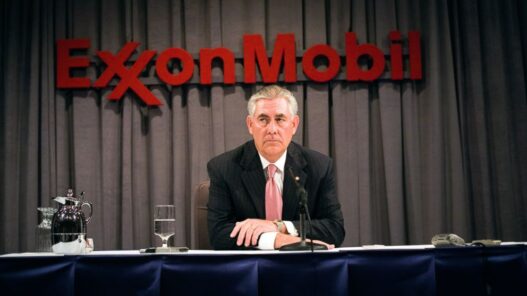

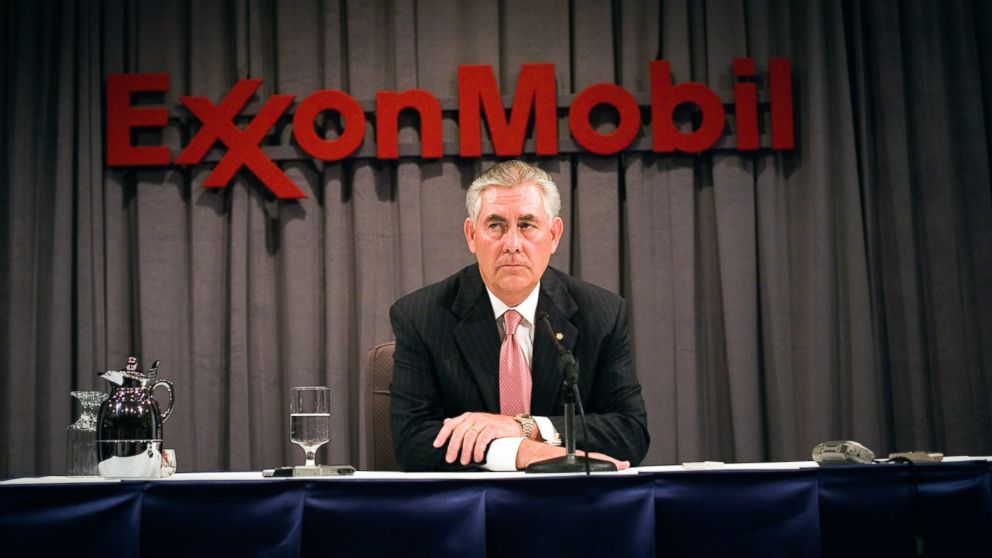

Confidential reports indicate that ExxonMobil, one of the world’s largest oil giants, may be considering a cautious re-entry into the Russian energy market, signaling a potentially major shift in global oil dynamics amid easing Western sanctions and changing geopolitical calculations. While the company has not confirmed the discussions publicly, industry analysts are watching closely, as any return could have profound implications for global energy supply and U.S.-Russia relations.

Background: Exxon’s Russian Exit

ExxonMobil was among several Western energy majors that suspended operations in Russia following the 2022 invasion of Ukraine. The company had long-standing investments in Siberia, particularly in Arctic oil and gas projects, which were among the most technologically advanced and lucrative in the world.

Following the suspension, Exxon and its peers faced significant financial and operational losses, while Russia sought to pivot its energy exports toward Asia, particularly China and India.

The Talks: What We Know

Sources familiar with the matter suggest that Exxon has been engaged in “preliminary, confidential discussions” with Russian counterparts regarding potential participation in oil and gas projects. These talks are reportedly focused on ensuring compliance with current U.S. and international sanctions while evaluating economic viability and operational risks.

A senior energy analyst noted:

“Exxon is weighing its options carefully. Russia offers vast reserves and high returns, but the geopolitical and regulatory risks remain substantial. Any move would be highly calculated.”

While no official deal has been announced, speculation alone has stirred market interest, with crude prices and energy equities showing modest reactions in early trading sessions.

Strategic Motives

For Exxon, returning to Russia could be a strategic maneuver to recapture lost production and strengthen its long-term global portfolio. Russian fields, particularly in Siberia and the Arctic, offer high-yield reserves that are difficult to replicate elsewhere.

For Russia, the potential involvement of a major Western oil firm like Exxon could help modernize extraction techniques, secure technology transfer, and signal to global markets that the country’s energy sector remains open for business despite sanctions.

Geopolitical and Market Implications

Exxon’s re-entry would also carry geopolitical weight. Any U.S.-based company operating in Russia would require careful alignment with Washington’s sanctions framework, potentially complicating U.S.-Russia diplomacy. European and Asian markets could also be affected if additional Russian supply enters global oil flows, possibly lowering prices in certain regions.

Analysts caution that a return is far from guaranteed. Washington and European capitals remain sensitive to perceived sanction circumvention, while market conditions, logistical constraints, and reputational risks weigh heavily on corporate decision-making.

Industry Reaction

Energy competitors, particularly Chevron and BP, are closely monitoring developments. Some European firms have already begun tentative discussions with Russian partners, signaling that a broader re-engagement could be underway if the regulatory and political environment permits.

Meanwhile, Russia is reportedly incentivizing Western firms to return by offering favorable tax arrangements and project concessions. This tug-of-war between risk and reward is emblematic of the complex calculus facing multinational energy companies today.

The Bottom Line

ExxonMobil’s potential re-entry into Russia underscores the intricate intersection of geopolitics, energy security, and corporate strategy. While the talks remain confidential, their mere existence highlights the allure of Russian oil, even amid ongoing international tensions.

For the global energy market, any move by Exxon would signal a possible shift in supply dynamics, with implications for pricing, investment flows, and the broader geopolitical balance between East and West.