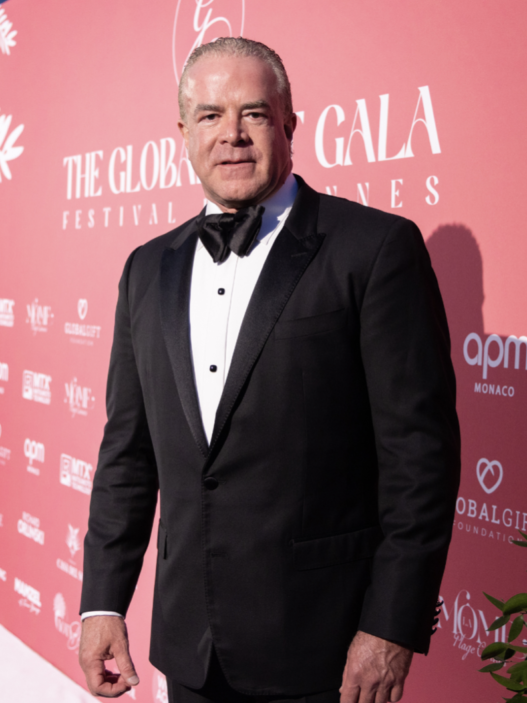

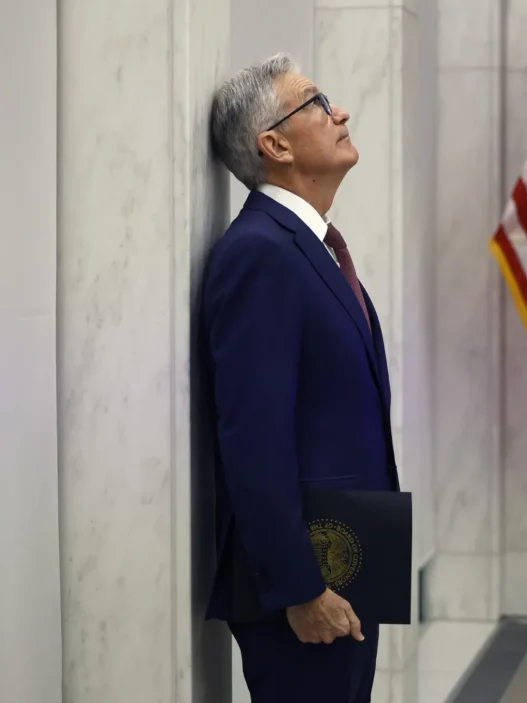

Federal Reserve Chair Jerome Powell recently articulated concerns over a “K-shaped economy” emerging in the United States, openly questioning its long-term viability. This economic pattern, where the wealthy experience significant gains while lower-income households face increasing strain, is something the Fed is actively observing in its data, according to Powell’s remarks following the latest rate-setting meeting. He acknowledged that the concept is “clearly a thing,” with evidence surfacing in the earnings reports of consumer-facing companies catering to low and moderate-income individuals, which consistently highlight belt-tightening and shifts in purchasing habits among these demographics.

The divergence is stark: asset values, encompassing both housing and securities, are elevated and predominantly held by those at the higher end of the income and wealth spectrum. Meanwhile, five years of cumulative price increases for essential consumer goods like food and energy continue to burden less affluent families. Powell’s candid admission, “How sustainable it is, I don’t know,” underscores a fundamental apprehension within the central bank. He pointed out that the majority of consumption is driven by those with greater means, with the top third accounting for a disproportionately large share, raising doubts about the overall health and equity of such an economic structure.

Further complicating the economic picture, Powell suggested that current job creation figures might be overstated. He revealed that the recent government shutdown had hampered the Bureau of Labor Statistics’ ability to collect accurate data, leading to potential distortions. The Fed chair indicated that while the labor market shows signs of gradual cooling, with unemployment rising slightly from June through September, payroll job growth averaging 40,000 per month since April might be inflated. He estimated an overstatement of approximately 60,000 jobs, which would imply a net loss of 20,000 jobs per month. This assessment is further supported by surveys of households and businesses, both indicating a decline in the supply and demand for workers.

Despite these underlying concerns, Wall Street reacted positively to the Fed’s decision to cut interest rates by 25 basis points, bringing the federal funds rate to 3.5%. The S&P 500 briefly touched a new record high before settling up 0.76% at 6,886. However, Powell also signaled a pause in immediate rate cuts, stating, “We’ve cut now three [times]. We’ve now cut a total of 175 basis points. And, as I mentioned, you know, we feel like we’re well positioned to wait and see how the economy evolves from here.” This stance suggests a period of observation for the Fed as it assesses the impact of its recent policy adjustments.

The market’s initial enthusiasm appeared to temper the following morning. S&P futures dipped 0.53%, and Nasdaq 100 futures were down 0.74% premarket. This shift could be attributed to several factors: Powell’s indication of no further immediate rate reductions, potential profit-taking by traders after the S&P’s previous day’s rise, and a disappointing earnings report from Oracle. The technology giant missed revenue expectations and disclosed a substantial increase in AI-related spending, leading to an 11.5% drop in its stock during overnight trading, adding another layer of complexity to the broader market sentiment.