General Fusion, a company focused on developing commercial fusion energy technology, has announced its intention to become a publicly traded entity through a special purpose acquisition company (SPAC) deal valued at approximately $1 billion. This move positions the Canadian firm to access significant capital markets, which are often crucial for the long-term, high-capital demands of advanced energy research and development. The transaction represents a notable step for a company operating in a field that has historically been the domain of government-funded research, signaling a potential shift towards private investment in fusion technology.

The agreement involves a merger with a SPAC, a shell company designed specifically to acquire private businesses and take them public. While the specific SPAC involved was not immediately detailed, these vehicles have become an increasingly popular route for companies, particularly those in nascent or high-growth sectors, to bypass the traditional initial public offering (IPO) process. Proponents argue SPACs offer a faster, more predictable path to public markets, though critics often point to potential valuation concerns and less stringent regulatory oversight compared to conventional IPOs. For General Fusion, securing a $1 billion valuation underscores investor confidence in the future potential of fusion power, despite the considerable scientific and engineering hurdles that remain.

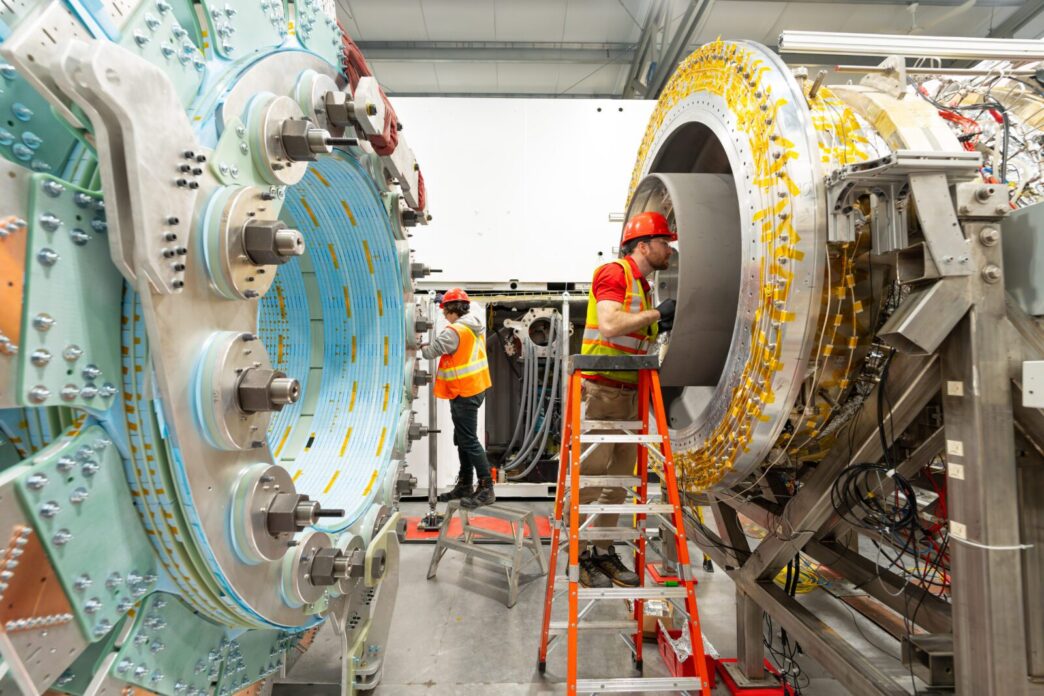

General Fusion, founded in 2002, has been pursuing a magnetized target fusion approach, a method that uses a collapsing liquid metal liner to compress and heat plasma to fusion conditions. This differs from the more widely known magnetic confinement fusion, like that pursued by the ITER project, or inertial confinement fusion. The company has attracted investment from notable figures, including Amazon founder Jeff Bezos, and has also received support from the Canadian government, highlighting the strategic interest in its technological advancements. Its facility near Vancouver, British Columbia, has been a hub for its experimental work, aiming to demonstrate the viability of its unique fusion concept.

Accessing public markets through this SPAC deal is expected to provide General Fusion with the financial resources necessary to accelerate its research and development efforts, particularly as it moves towards constructing a larger-scale demonstration plant. The development of commercially viable fusion energy is often described as the “holy grail” of clean energy, promising a virtually limitless, carbon-free power source. However, achieving net energy gain — where the fusion reaction produces more energy than is consumed to initiate and sustain it — at a cost-effective scale has proven to be an immense scientific and engineering challenge for decades.

This announcement comes at a time of increasing private sector interest in fusion energy. Several startups around the globe are exploring various fusion concepts, each vying to be the first to deliver a commercially viable solution. The influx of private capital into these ventures suggests a growing belief that breakthroughs are within reach, driven by advancements in materials science, computational modeling, and magnet technology. General Fusion’s decision to go public via a SPAC could set a precedent for other privately funded fusion companies looking to scale their operations and attract broader investor participation in this high-stakes technological race. The coming years will reveal whether this financial maneuver provides the necessary impetus for General Fusion to achieve its ambitious energy goals.