In Thailand, an estimated 15 million individuals find themselves locked out of formal financial services, despite possessing the capacity to repay loans. This significant segment of the population, often comprising micro and small business owners, represents a considerable lending opportunity that traditional banks have largely failed to address. Their reliance on conventional metrics like financial statements, payslips, or credit bureau assessments, a model Tanyapong Thamavaranukupt, co-president of Thai fintech Ascend Money, describes as having been “there for the last 30 years,” has created a substantial gap in financial inclusion.

Ascend Money, the fintech arm of Thailand’s CP Group, is attempting to bridge this divide through an alternative approach. Instead of traditional credit checks, their lending service, Ascend Nano, leverages data from its digital wallet. This allows the company to build risk profiles for customers based on transaction types, spending locations, and even the kind of mobile phone they use. Tanyapong notes that a consistent magazine subscription, for instance, might indicate a degree of education and thus potentially higher income, signaling a safer lending prospect. This data-driven strategy enables Ascend Money to extend credit to individuals and small enterprises that lack the formal documentation required by established institutions.

The need for such services is particularly acute in Southeast Asia, where 225 million people lacked access to a formal bank account in 2021, and approximately 350 million could not secure formal financing. Small and medium-sized enterprises (SMEs) in the region also face significant hurdles, with over half unable to obtain necessary funding as of 2018. This financial exclusion often pushes individuals and businesses toward informal lenders, who frequently charge exorbitant interest rates, sometimes as high as 20% per month. Ascend Nano, by contrast, offers loans at a rate of 2%, providing a more sustainable alternative.

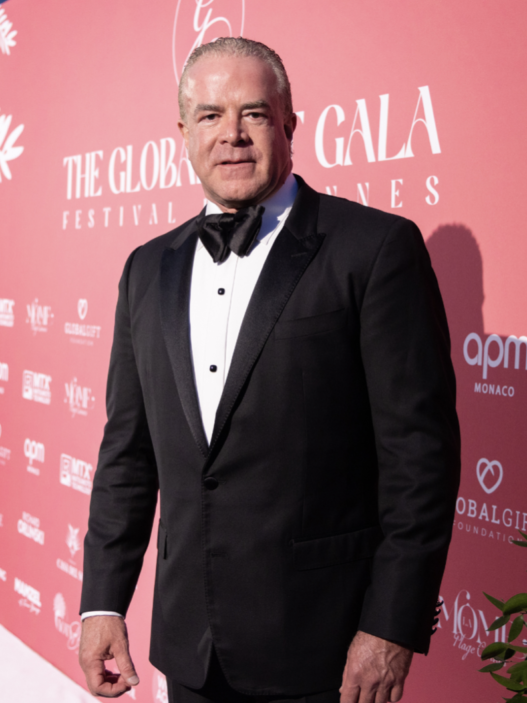

Ascend Money’s innovative approach to assessing creditworthiness has garnered attention, leading to its inclusion on Fortune’s 2025 “Change the World” list, which highlights businesses creating positive societal impact through their models. The company began its journey focusing on payments and money transfers, but slim margins in those areas prompted an expansion into other financial services, with Ascend Nano being among the first initiatives. These “nano finance” offerings can be as small as $20, targeting consumers and small businesses in Thailand.

The synergy with the broader CP Group, a conglomerate with interests spanning retail, agriculture, and manufacturing, further enhances Ascend Nano’s reach. Many of its clients, particularly operators of small roadside stalls, purchase their inventory wholesale from CP Makro, the group’s cash-and-carry wholesaler. By analyzing purchasing history, Ascend can offer credit lines for these businesses to procure goods from CP Makro, an initiative that has reportedly helped customers double their working capital. This integrated ecosystem allows for a more holistic understanding of customer financial behavior beyond conventional banking parameters.

Tanyapong Thamavaranukupt, who joined Ascend Money in 2016 after a 15-year career in Thailand’s finance industry, including leadership roles at major banks, brings a blend of traditional financial expertise and an understanding of the need for innovation. His perspective underscores the belief that a large portion of the underbanked population is creditworthy, but simply underserved by outdated models. The landscape of small-scale lending remains competitive, with a few dominant players, but Ascend Money is also exploring other “nano” financial products, such as insurance and investment options, recognizing that many of their customers, including a substantial number of motorcycle drivers, often lack basic financial protection. This expansion signifies a broader ambition to provide comprehensive financial inclusion for a demographic traditionally overlooked.