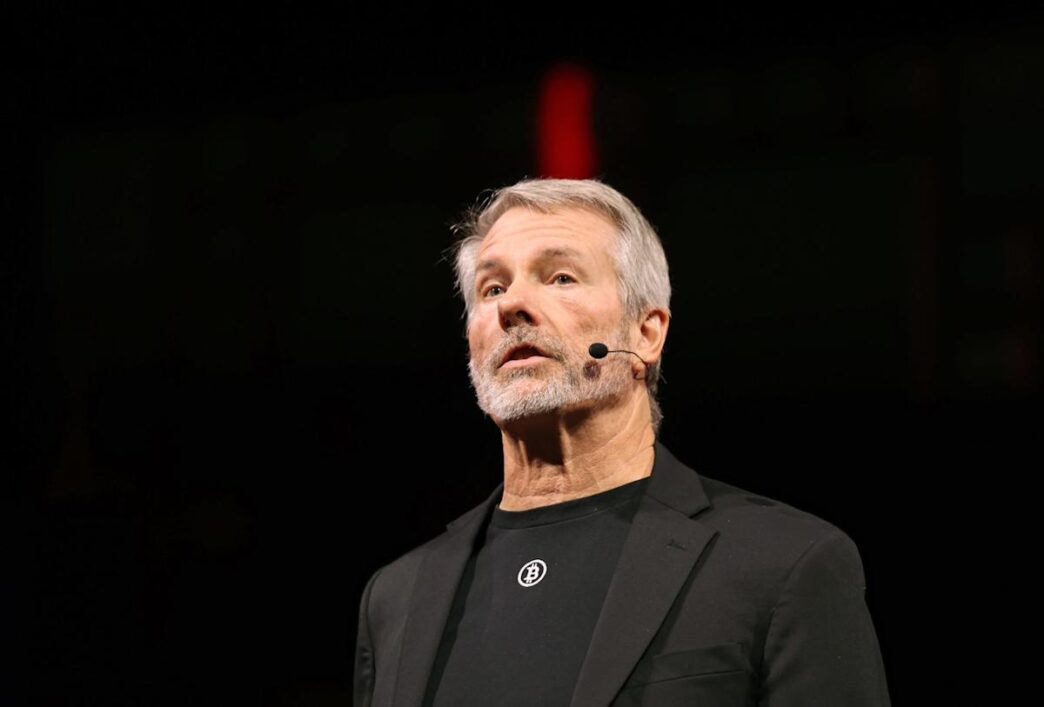

The market valuation of Strategy, Michael Saylor’s Bitcoin-centric company, has once again approached a critical juncture, with its stock performance raising questions among investors. While shares saw a modest 1.22% increase in early trading, offering a brief reprieve, the company’s trajectory has been largely downward since last July, shedding 66% of its value from that peak. This volatility places renewed focus on Strategy’s unique financial model, particularly its reliance on Bitcoin and a metric known as “mNAV,” or market-to-net asset value.

This mNAV figure, which gauges whether the company’s market capitalization, adjusted for debt and cash, is worth more or less than its underlying Bitcoin reserves, stood at 1.02 this morning. A dip below 1.0, signaling that the company is technically valued at less than its Bitcoin holdings, could trigger a significant sell-off. For many investors, the core premise of owning Strategy stock is its direct exposure to Bitcoin; if that exposure comes at a discount to simply holding Bitcoin directly, the investment case weakens considerably. The company has largely managed to stay above this precarious threshold since November, but the current proximity underscores the ongoing tension between its stock performance and its digital asset strategy.

Adding another layer of complexity, the company’s current market capitalization of $47 billion already lags behind the nearly $60 billion value of its Bitcoin reserves. This disparity, while not directly tied to the mNAV metric, highlights a fundamental challenge: the market currently values the entire corporate entity, including its operations and other assets, at less than its primary digital holding. Should the mNAV also fall below 1, it could usher in a new phase of investor apprehension for Strategy.

Despite these financial headwinds, Michael Saylor has maintained his characteristic bullish stance on Strategy shares. His recent social media activity included a chart pointing to significant “open interest” in MSTR, suggesting that investor positions, while potentially including short bets against the company, indicate high trading activity. He also shared an AI-generated image depicting himself taming a polar bear, a symbolic gesture perhaps intended to convey control and resilience in a volatile market.

Beyond the immediate mNAV concern, Strategy faces another crucial benchmark: the average price at which it has historically acquired Bitcoin. This figure hovers around $74,000 per coin. With Bitcoin currently trading at approximately $89,600, there remains a comfortable margin. However, a significant downturn in Bitcoin’s price, pushing it below that $74,000 accumulation cost, would imply that Strategy’s substantial Bitcoin trove is worth less than what was initially paid for it.

Proponents of Strategy’s strategy might argue that such a scenario, where the stock trades below the value of its Bitcoin, could present a buying opportunity. The theory suggests that the stock price might eventually converge with, or even exceed, the value of its underlying Bitcoin, especially if the cryptocurrency were to resume an upward trajectory. Yet, for investors less committed to the long-term vision and more focused on immediate returns, holding a stock that trades at a discount to its core asset presents a difficult proposition, testing the conviction of even seasoned traders.