Microsoft recently announced robust financial results, including its cloud division surpassing $50 billion in quarterly revenue, yet investor sentiment appears to be tempered by specific concerns. The tech giant’s demand backlog has more than doubled, reaching an impressive $625 billion, a significant portion of which is attributed to its partnership with OpenAI. Despite these headline figures, Microsoft’s stock experienced a nearly 5% dip in after-hours trading following its second-quarter earnings release, signaling a cautious reception from the market.

A primary point of contention for investors revolves around the deceleration in Azure’s revenue growth, coupled with substantial capital expenditures. Azure’s growth rate saw a slight decline, moving from 40% in the first quarter to 39% in the second. This marginal dip, alongside the company’s admission of capacity constraints extending potentially until the end of its fiscal year in June, has prompted questions regarding Microsoft’s ability to scale its computing infrastructure quickly enough to meet burgeoning AI demand. Analysts, like Morgan Stanley’s head of U.S. software research, Keith Weiss, highlighted the concern that capital expenditure is outpacing Azure’s revenue growth, raising questions about the return on investment for these large outlays.

The scale of Microsoft’s infrastructure spending is considerable. In the first quarter of fiscal 2026 alone, capital expenditures reached $34.9 billion, with roughly half allocated to essential assets such as GPUs and CPUs for PCs, servers, and Azure data centers. The second quarter saw another $37.5 billion in capex, bringing the first half total to $72.4 billion. This substantial investment is fueling the expansion necessary to support growing demand, particularly for AI-driven services. Chief Financial Officer Amy Hood acknowledged the ongoing demand exceeding available supply across various workloads, customer segments, and geographic regions.

During the earnings call, Hood addressed investor anxieties directly, pushing back on the notion that a direct correlation should be drawn between capital expenditures and solely Azure’s revenue. She clarified that the company’s investment strategy is multifaceted, prioritizing increased usage and sales of products like M365 Copilot and GitHub Copilot. Following these immediate needs, Microsoft funnels resources into research and development and product innovation—long-term strategic investments. The remaining capacity then supports Azure’s continued growth. Hood even suggested that if all new GPUs from the first and second quarters had been exclusively directed to Azure, its growth figures would have significantly surpassed the reported 39%.

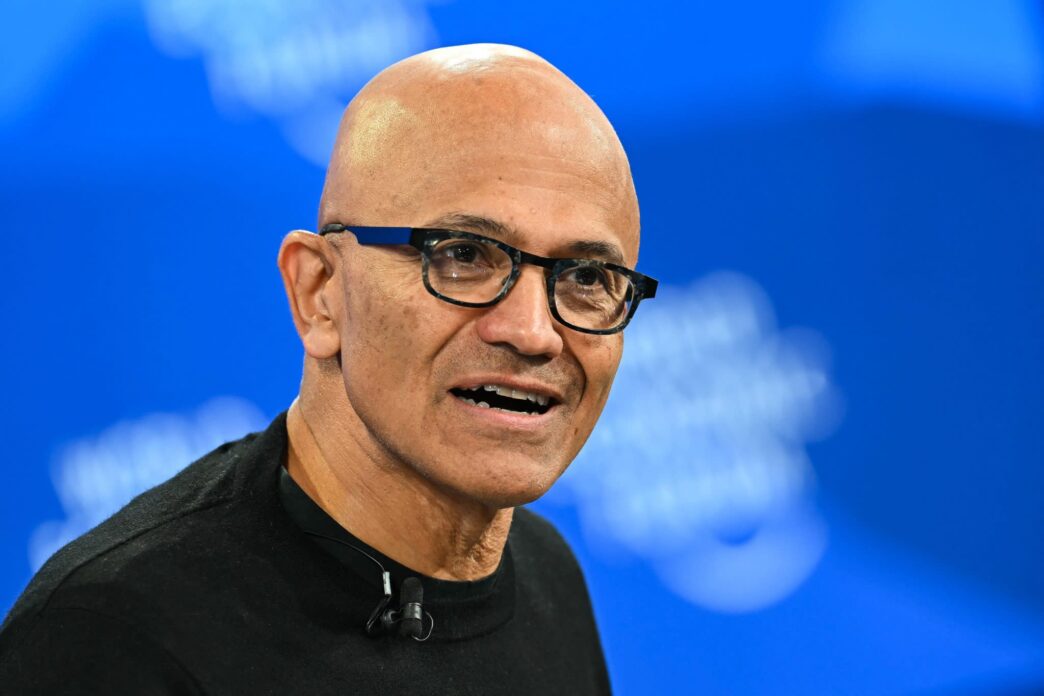

Chairman and CEO Satya Nadella reinforced Hood’s perspective, urging investors to consider the broader AI ecosystem within Microsoft’s portfolio rather than focusing solely on Azure. He emphasized that while acquiring an Azure customer is crucial, so is securing users for M365, GitHub, Dragon, and Security Copilot, all of which heavily leverage AI. Nadella framed compute spending as akin to research and development, an investment optimized for long-term strategic advantage across the entire enterprise. This holistic view suggests that the benefits of current capital outlays extend beyond immediate Azure growth, contributing to the development and deployment of a wider array of AI-powered offerings.

Despite these explanations, concerns persist among investors regarding whether ongoing capacity constraints could impede the conversion of Microsoft’s record-setting remaining performance obligations (RPO) backlog into revenue as rapidly as Wall Street expects. The RPO, which surged 110% year-over-year to $625 billion, includes a substantial $250 billion commitment from OpenAI announced in October. Hood, however, reassured that approximately $344 billion of this RPO comes from a diverse array of other customers, indicating a broad-based demand that grew 28% year-over-year, outpacing many of Microsoft’s peers.

Despite the market’s immediate reaction, Microsoft’s overall financial performance for the second quarter was robust. The company reported revenue of $81.3 billion, a 17% increase from $69.6 billion in the prior year, exceeding its own guidance. Operating income climbed 21% to $38.3 billion, and diluted earnings per share rose 24% to $4.14. The cloud business notably achieved its first-ever quarterly revenue exceeding $50 billion, reaching $51.5 billion, marking a 26% year-over-year growth. These figures underscore a company experiencing significant top-line expansion, even as it navigates the complexities of massive infrastructure investments to meet future AI demand.