Prime Group, the Singapore-based investment platform specializing in resource development, has announced a proposed move into Southeast Asia through a potential acquisition of a controlling stake in Cambodia’s offshore Apsara oil field. The initiative marks a geographic diversification for the Group and signals its growing interest in Southeast Asian energy assets.

The proposed transaction is being pursued via a Prime Group affiliate and remains subject to comprehensive due diligence, regulatory approvals, and the execution of final agreements. An exclusivity arrangement allows Prime Group to evaluate the asset across technical, legal, and commercial dimensions before any binding commitment is made.

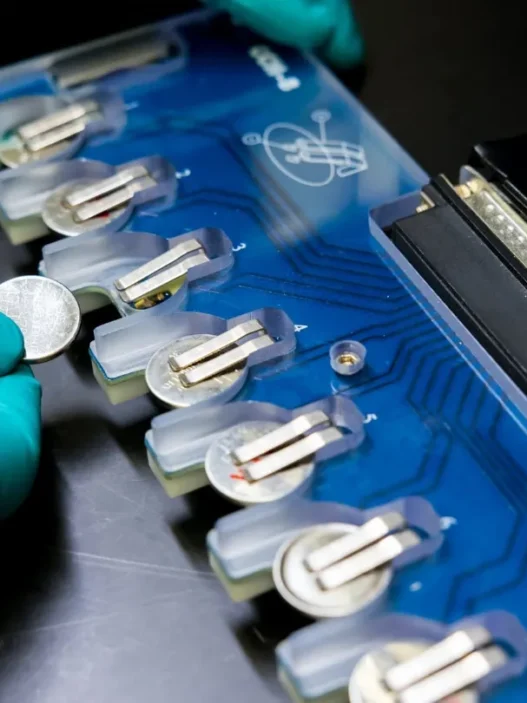

The Apsara field holds historical significance as Cambodia’s first producing oil field. Previous operators conducted appraisal drilling and seismic surveys that indicated commercially viable hydrocarbon presence across multiple wells. These historical datasets are expected to form part of Prime Group’s assessment of future development potential and capital requirements.

Prime Group is considering a structure that could result in up to a 70 percent participating interest alongside joint venture arrangements with the current license holder. If completed, the structure would position Prime Group in a leading operational and managerial role, while maintaining alignment with local regulatory frameworks.

CEO Karim Bouhout described the move as part of Prime Group’s measured international expansion strategy. He emphasized that the company focuses on assets with established geological work, documented resource potential, and realistic development pathways. According to Bouhout, Southeast Asia represents a region where economic growth and energy demand continue to create long-term strategic opportunities.

The potential Cambodia entry also aligns with Prime Group’s broader capital markets roadmap as it advances toward a planned Singapore Exchange listing. The Group has articulated a strategy centered on building a diversified portfolio of asset-backed projects that can support sustainable value creation.

Prime Group has indicated that recent funding arrangements and capital partnerships provide capacity for selective investments in the energy and natural resources sectors. The company maintains that capital deployment is guided by risk management, asset fundamentals, and long-term commercial viability.

The Group noted that the announcement reflects strategic intent and ongoing evaluation. There is no assurance that the acquisition will be completed in its current form or within a specific timeframe.

About Prime Group

Prime Group is an international investment and trading platform focused on energy, mining, and agricultural assets. Headquartered in Singapore, the company develops partnerships and investment structures aimed at in-region value creation and resource development. Prime Group operates across multiple markets and is preparing for a future public listing.