For much of 2024 and 2025, the dominant economic narrative in the United States has been one of resilience. Unemployment remains low, inflation is easing, and corporate earnings have largely beaten expectations. Wall Street economists have increasingly embraced the once-unlikely idea of a “soft landing”—that the Federal Reserve could tame inflation without triggering a recession.

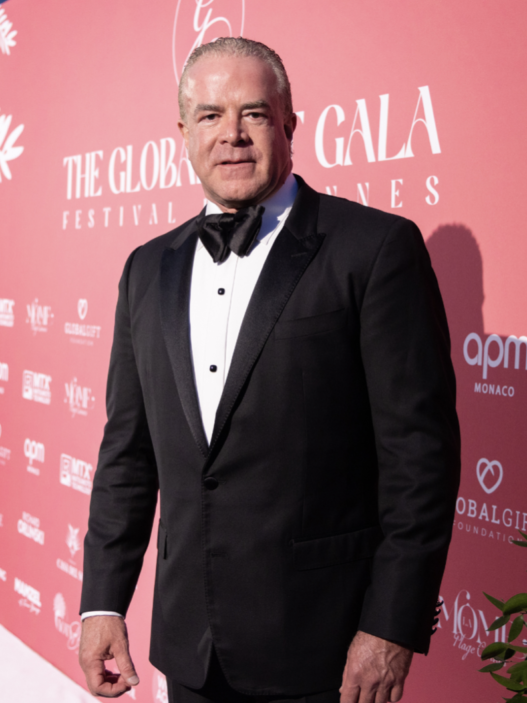

But author, financial analyst, and economic commentator Kyla Scanlon sees something else entirely: pressure building beneath the surface—pressure that could soon crack the foundation of the U.S. economy.

Appearing on this week’s Everybody’s Business podcast, Scanlon—known for coining the term “vibecession” to describe the emotional instability behind economic behavior—highlighted three underreported but alarming economic indicators she says reveal growing structural fragility.

The New Economic Warning System

According to Scanlon, the traditional indicators often cited by policymakers—GDP growth, headline inflation, nonfarm payroll numbers—have become lagging narratives that fail to capture real-time economic stress. Instead, she argues we should be watching:

1. Delinquency Rates Are Rising—Fast

While consumer spending has remained surprisingly strong, much of it is being propped up by credit, Scanlon warns.

- Credit card delinquencies have surged to their highest level in over a decade.

- Auto loan delinquencies are now above Great Recession levels for subprime borrowers.

- Younger households are increasingly struggling with debt servicing.

“The story isn’t that consumers are strong,” Scanlon said. “The story is that consumers are stretching—and that stretch is not sustainable when interest payments are this high.”

2. Small Businesses Are Flashing Recession Signals

Scanlon points to data from the National Federation of Independent Business (NFIB) showing:

- Profit margins for small businesses are shrinking.

- Hiring plans are slowing despite low unemployment.

- Loan approval rates have fallen sharply due to high interest costs.

“These are the employers that make up nearly half of American jobs,” she noted. “When small businesses pull back, it’s historically one of the clearest early warning signs of a downturn.”

3. Consumer Sentiment Remains Shockingly Low

Despite stable economic data, public sentiment about the economy is deeply pessimistic. Scanlon says this disconnect matters—a lot.

“Recessions aren’t just economic events—they’re social events,” she said. “If people feel unstable, they spend less. And when they spend less, the economy becomes unstable. That reflexive feedback loop is powerful—and dangerous.”

Consumer sentiment remains closer to recession-era levels than expansionary ones, suggesting a confidence-based slowdown could be brewing beneath the surface.

The “Vibecession” Lives On

Scanlon, author of In This Economy?, argues that explaining today’s economy through old models is a mistake. “We’re in a different kind of downturn risk—a psychological one driven by inequality, debt load, and distrust,” she said.

She suggests policymakers and analysts are underestimating fatigue among U.S. consumers and overestimating financial resilience. Even as wage growth improves, real purchasing power has not fully recovered from the inflation surge of 2022–2023.

Why Wall Street May Be Missing the Signals

Markets are currently pricing in optimism—AI stock rallies, IPO markets awakening, and corporate M&A activity picking up. But Scanlon believes this optimism reflects financial market concentration, not economic health.

“The stock market doesn’t represent the economy. It represents the top layer of it,” she said. “And right now, that layer is disconnected from the financial reality of most households and businesses.”

So—Is a Recession Coming?

Scanlon isn’t predicting an imminent collapse. Instead, she warns of a slow compression—a grinding economic decline rather than a dramatic crash.

“It’s not that we’re falling off a cliff,” she said. “It’s that we’re sinking in slow motion.”

She expects:

✅ Slower economic growth in 2025

✅ Rising defaults in consumer credit

✅ Pressure on small business employment

✅ Increasing political and social tension tied to economic stress

Final Thoughts

Kyla Scanlon’s message is not doom—but clarity. The U.S. economy may look healthy on the surface, but the engine underneath is overheating, powered by expensive credit and fraying consumer confidence. She argues that ignoring early warning signs today could lead to painful consequences tomorrow.

“The best time to act is before a crisis,” Scanlon said. “We’re not there yet—but we’re heading in that direction. And the numbers are telling us so—if we’re willing to look.”