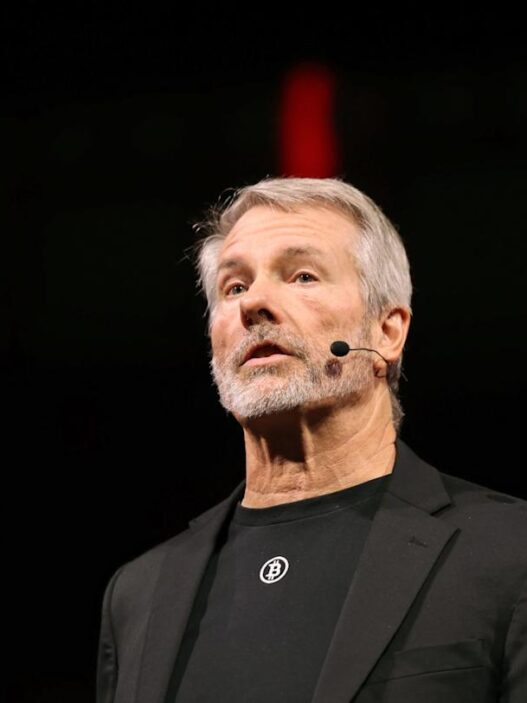

As artificial intelligence continues its meteoric rise, reshaping industries and investor expectations worldwide, private-market giants are rushing to secure stakes in the next generation of AI winners. But according to Orlando Bravo, co-founder of private-equity powerhouse Thoma Bravo, the investment mania sweeping through venture capital, growth equity, and technology buyouts is setting the stage for costly mistakes.

In a candid assessment of current market sentiment, Bravo cautioned that FOMO—fear of missing out—is driving investors to strike overpriced deals, cut corners on diligence, and overestimate near-term AI monetization potential. His warning echoes a broader concern across the financial industry: the unprecedented hype around AI, particularly generative AI, risks inflating asset prices to unsustainable levels.

For private markets already grappling with high interest rates, tighter liquidity, and slowing exit activity, misjudging the AI wave could have repercussions that last for years.

The New Gold Rush: AI Has Become the Most Sought-After Private-Market Asset Class

In 2024 and 2025, AI has transformed from a niche category into the hottest investment theme across global capital markets. Private-equity firms, venture capital funds, sovereign wealth vehicles, and corporate strategic investors are all aggressively pursuing:

- Foundational model developers

- AI-enabled enterprise software companies

- Infrastructure providers (GPU suppliers, data centers)

- Autonomous systems

- Verticalized AI applications in healthcare, finance, defense, and logistics

With valuations soaring—and many startups raising capital at multi-billion-dollar levels despite limited revenues—Bravo argues that the private markets may be reprising the tech bubble behaviors of the late 1990s and the unicorn frenzy of the 2015–2021 era.

“The problem,” Bravo warns, “is not AI itself. It’s the emotional investing psychology forming around it.”

Bravo’s Central Warning: FOMO Is Clouding Judgement

According to Bravo, investors who missed earlier AI rallies now feel compelled to participate at any price. This FOMO-driven mindset leads to several critical missteps:

1. Overpaying for Growth That Isn’t Yet Real

Many AI startups show explosive user interest but limited revenue visibility. Investors extrapolate future dominance without understanding actual monetization paths.

2. Diligence Shortcuts

In competitive fundraising rounds, investors face pressure to close deals quickly. Bravo notes that skipping technical audits, customer reference calls, or product validation increases failure risk.

3. Mispricing Hardware-Dependent Business Models

AI’s infrastructure costs are massive. Foundational models and inference workloads require expensive GPUs, cloud compute, and specialized chips. Many investors underestimate cost structures or assume prices will fall faster than they realistically will.

4. Misjudging Competitive Moats

In the current AI arms race, moats are fragile. Bravo argues that investors often project enduring competitive advantage onto companies operating in markets where barriers to entry remain low and technology cycles move rapidly.

5. Underestimating Regulatory Risk

From data privacy to intellectual property and national-security restrictions, AI regulation is rising sharply. Investors who fail to anticipate shifts could see valuations unravel.

Ultimately, Bravo says, “Investing out of fear—rather than conviction and analysis—creates the environment where the biggest mistakes happen.”

Warnings Born from Experience: Thoma Bravo’s Tech Track Record

Bravo’s caution is grounded in decades of experience investing in enterprise software and technology-enabled businesses. Thoma Bravo has acquired and scaled companies including:

- Dynatrace

- Ping Identity

- SailPoint

- Proofpoint

- Coupa

Across its portfolio, the firm has maintained a disciplined approach to valuation, cash flow generation, and sustainable growth—avoiding the kind of speculative bets that fueled past tech bubbles.

Bravo is not dismissing AI’s transformative potential. On the contrary, he views it as one of the most powerful technological revolutions of the century. His concern lies with the behavior of investors in private markets, not the technology itself.

The Broader Context: Private Markets Are Under Pressure

The warning comes at a sensitive moment for global private markets:

Higher Interest Rates

Financing buyouts and late-stage VC rounds is more expensive, reducing returns and increasing risk.

Liquidity Crunch

IPOs have slowed, M&A pipelines remain cautious, and LPs—limited partners—are experiencing allocation constraints.

Stretched Valuations

Many tech companies that raised money at 2021 peak valuations still have not grown into those prices, creating tension around down rounds.

Capital Concentration

AI has become a winner-take-most theme, with select companies capturing enormous shares of funding while others struggle.

Bravo argues that these pressures heighten the temptation for investors to chase AI at any cost—precisely the environment where mistakes compound.

A More Mature AI Cycle Requires Discipline

Bravo emphasizes that successful AI investing requires a return to fundamentals:

A. Understand the Actual Technology

Private-equity firms must go beyond buzzwords, building deep technical expertise and validating whether a company’s AI truly works at enterprise scale.

B. Measure Unit Economics Carefully

AI margins are not guaranteed. Understanding compute cost, customer acquisition cost, and long-term profitability is crucial.

C. Focus on Sustainable Business Models

The winners will be companies that solve real problems—not those riding hype cycles.

D. Resist Overpaying

Bravo warns that “valuation discipline is the only protection investors have in a bubble.”

E. Expect Many Failures

Just as the internet boom produced both Amazon and hundreds of failed startups, the AI boom will create global giants but also widespread losses.

Implications for Venture Capital and Growth Equity

VCs and growth-equity firms are especially vulnerable to Bravo’s warnings:

- Competition for deals is ferocious

- Term sheets are issued at lightning speed

- Some investors are betting on “model-first” companies without usage metrics

- Many firms are over-concentrating in the same themes (enterprise copilots, generative AI assistants, autonomous agents)

Bravo suggests that only disciplined firms with strong governance frameworks will avoid the pitfalls now forming across the industry.

Conclusion: A Necessary Reality Check for AI Investors

Orlando Bravo’s message is clear:

AI is transformative—but the private-market rush to capture returns is already producing behavior that will end in losses for many investors.

The challenge for private markets in 2025 is to balance boldness with restraint, excitement with diligence, and conviction with discipline. Bravo’s warning is not pessimistic; it is pragmatic.

The firms that heed it may emerge as leaders of the AI era.

The firms that ignore it may repeat the mistakes of every tech bubble past.