The U.S. electric vehicle (EV) industry, once positioned for aggressive expansion, is facing a sharp reversal as President Donald Trump’s rollback of EV tax credits ripples through the supply chain. Industry analysts warn that the policy shift is creating a battery surplus that could force manufacturers to pause, scale back, or even cancel factory projects—jeopardizing America’s long-term bid to dominate clean energy and advanced manufacturing.

The EV Tax Credit Rollback

During his latest policy push, Trump targeted the Biden-era Inflation Reduction Act (IRA), which included generous tax credits for EV buyers and subsidies for battery production. By cutting key consumer incentives, Trump argued he was leveling the playing field and protecting U.S. automakers from what he calls a “forced EV transition.”

But for manufacturers, the removal of these credits has dealt a major blow. Without subsidies, consumer demand for EVs has slowed, leading to lower sales forecasts and leaving battery producers with excess capacity.

“Tax credits were the bridge between where EV demand is today and where it needed to be to support long-term investments,” said energy economist Sarah Miller. “By pulling away that bridge too soon, you risk stranding billions of dollars in new factories.”

Battery Plants at Risk

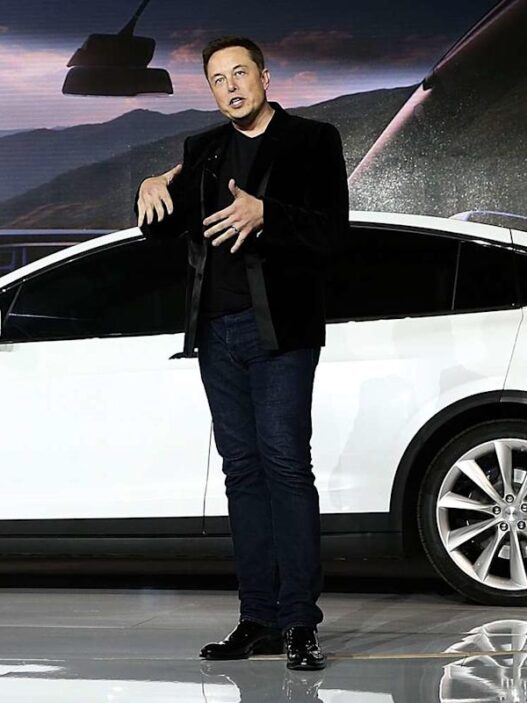

Over the past three years, automakers and battery giants—including Tesla, Ford, GM, Panasonic, and LG Energy Solution—announced dozens of new U.S. gigafactories, backed by federal subsidies and private investment. These projects were expected to secure domestic supply chains, reduce reliance on China, and create tens of thousands of high-paying jobs.

Now, with slower EV sales growth, those same factories are at risk of becoming underutilized or canceled altogether. Industry insiders describe the dynamic as a “poison pill” for U.S. manufacturing hopes: a glut of battery production without enough demand to absorb it.

“Factories can’t run at half capacity for long—they’re too capital intensive,” explained Miller. “If demand doesn’t catch up, some of these plants will simply never open their doors.”

A Battery Surplus Emerges

Signs of oversupply are already evident. Companies have reported higher-than-expected inventories of lithium-ion batteries, and prices for certain battery cells are falling faster than anticipated. While cheaper batteries could, in theory, make EVs more affordable, the absence of consumer tax incentives blunts that effect.

Moreover, EV adoption remains uneven across the U.S., with many consumers still deterred by high upfront costs, charging infrastructure gaps, and range anxiety. The removal of tax credits only amplifies these concerns, further slowing demand.

Ripple Effects Across the Economy

The implications go beyond EV sales. Battery factories were central to broader U.S. industrial policy, seen as a way to boost domestic jobs, strengthen energy independence, and counter China’s dominance in clean tech. A wave of project delays or cancellations could derail these ambitions.

- Jobs: Tens of thousands of expected positions in states like Michigan, Kentucky, Tennessee, and Georgia may not materialize.

- Supply Chains: Without steady EV growth, the U.S. risks ceding control of battery materials and technology back to Asia.

- Innovation: Investment slowdowns could stall progress in next-generation batteries, such as solid-state designs.

A Win for Rivals Abroad

Ironically, the U.S. battery surplus could benefit foreign competitors. China, South Korea, and Europe continue to invest heavily in EV adoption and infrastructure, ensuring steady demand for batteries and strengthening their manufacturing ecosystems.

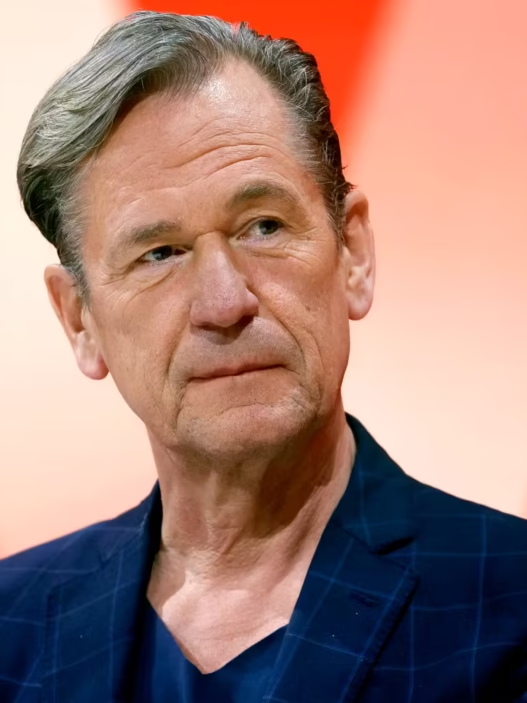

“The U.S. risks handing the future of clean transportation back to its rivals,” warned James Anderson, a former Department of Energy official. “Factories don’t just represent today’s jobs—they represent the innovation platforms of tomorrow.”

What Comes Next

Industry leaders are now lobbying for either a reinstatement of consumer incentives or new measures to stabilize demand. Some are exploring export opportunities for surplus batteries, though this strategy could be limited by global competition and trade tensions.

Others predict that the slowdown could force consolidation in the battery industry, with only the largest and most financially secure players surviving. Smaller or newer entrants may struggle to justify their investments.

Conclusion

Trump’s rollback of EV tax credits has sparked an unintended chain reaction: dampened consumer demand, a looming battery glut, and the potential collapse of ambitious U.S. factory plans. What was once a cornerstone of America’s green industrial strategy could now become a cautionary tale about the fragility of industrial policy when politics intervenes.

As one analyst put it: “You can’t build the future of American manufacturing on half-finished factories. Without demand, the dream of U.S. EV leadership may stall before it ever truly takes off.”